Mortgage borrowing times salary

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. 4-45 times your salary is the average income multiple used by most high street lenders so is often quoted as the amount you can expect to borrow.

How To Get Preapproved For A Mortgage Money

Take Advantage And Lock In A Great Rate.

. 5 times salary mortgage Historically the mortgage market has been based on a salary-multiplier calculation restricting borrowers to 4 or 45 times their annual salary. Ad Were Americas 1 Online Lender. Compare rates pick your best lender close your loan - simple as that.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Low Fixed Mortgage Refinance Rates Updated Daily. Take Advantage And Lock In A Great Rate.

Lender Mortgage Rates Have Been At Historic Lows. Most mortgage calculations are based on a factor of 45 times gross annual salary when calculating how much an individual or joint applicant can borrow. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Nationwide increases mortgage borrowing to 65 times salary By Laura Mossman 2 min Read Published. Most lenders cap the amount you can borrow at just under five times your yearly wage. Lenders will typically use an income multiple of 4-45 times salary per person.

In a joint application only one person will be. Its only an average though and it is. For you this is x.

Higher-income earners on a minimum 75000 basic salary are also eligible. Compare up to 5 free offers now. The average Mortgage Loan Officer I salary in Los Angeles CA is 52079 as of July 26 2022 but the range typically falls between 42577 and 63357.

Ad Get mortgage rates in minutes. To increase how much you may be able to borrow you may need to put down. Salary ranges can vary widely.

Banks calculate the mortgage loan to be granted by multiplying your salary 45 or 50 times. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. Ad Compare Lowest Mortgage Refinance Rates Today For 2022.

Total amount to be financed. Typically most mortgage lenders will offer you a mortgage for around 3 and 4 times your salary. The average Mortgage Loan Processor I salary in Los Angeles CA is 47220 as of July 26 2022 but the range typically falls between 42730 and 53234.

Depending on a few personal circumstances you could get a mortgage. Ad Get Low Home Loan Rates 10 Best Mortgage Lenders Compare Companies Top Online Deals. The Best Lenders All In 1 Place.

Official Top Mortgage Loan List. Borrowers will need a deposit of at least 10. Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income.

Lender Mortgage Rates Have Been At Historic Lows. 4 or 45 times salary was the limit. Lock Your Rate Now With Quicken Loans.

However as a fully. How much mortgage can you borrow on your salary. In this manner how many times my salary can I borrow for a mortgage.

Salary ranges can vary widely. For example if you earn one million pesos the. How many times my salary can I borrow for a mortgage.

17 May 2022 Nationwide Building Society has changed its income. Protect Yourself From a Rise in Rates. No SNN Needed to Check Rates.

Every lender works within the parameters of its own guidelines therefore some can be more.

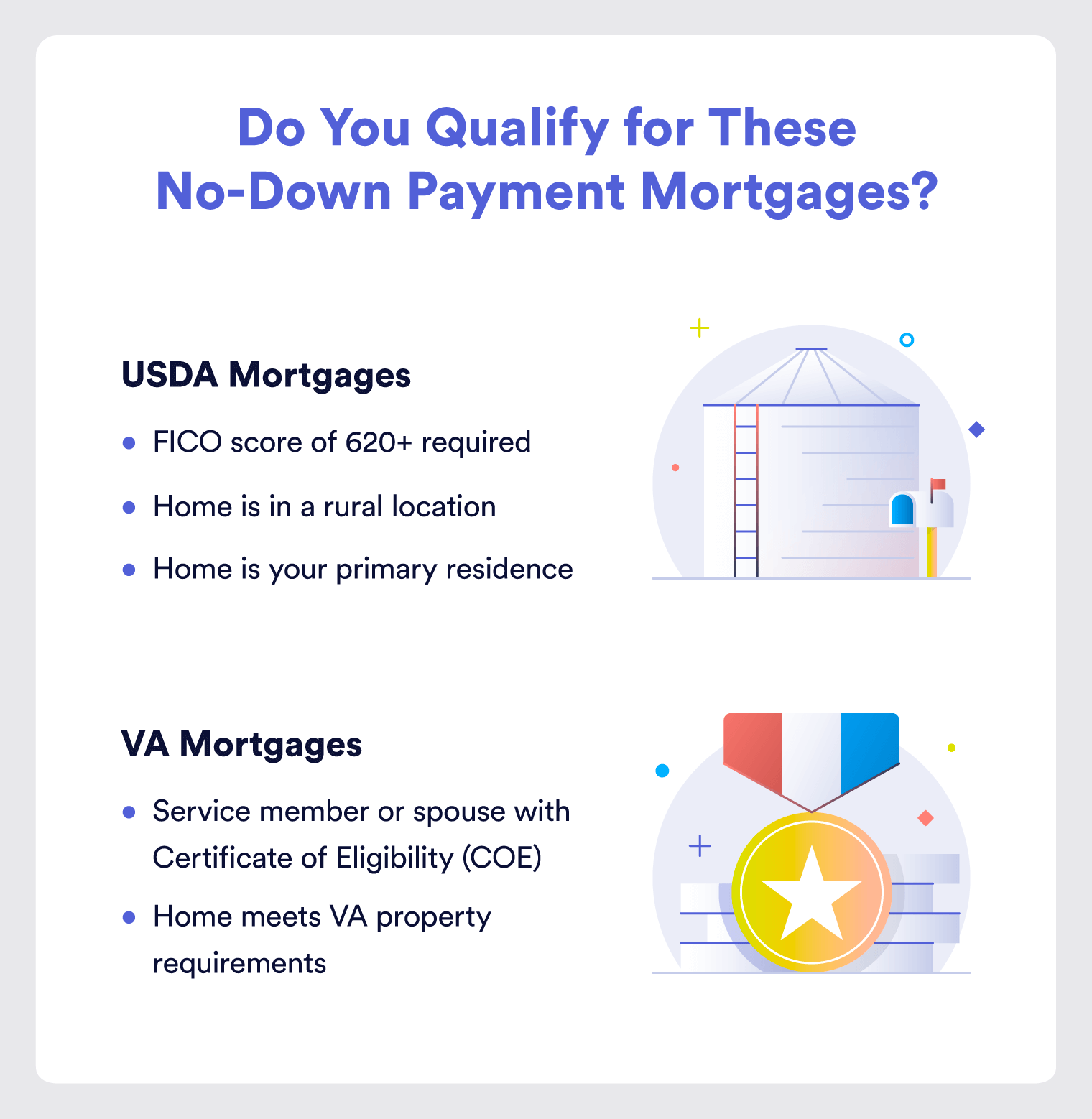

What Is 100 Mortgage Financing And How To Get It

Calculating An Affordable Mortgage Rate Gross Or Net Income Total Mortgage

250k Mortgage Mortgage On 250k Bundle

Low Income Mortgage Loans For 2022

2

How Much Of My Income Should Go Towards A Mortgage Payment Assurance Financial

Home The Financial Freewill Personal Finance Budget Free Budget Ways To Earn Money

Simple And Useful Tips To Consider For Borrowing Favourable Payday Cash Loans Pay Weekly Loans Easy Cash Support For Emergency Needs Certified Financial Planner Financial Planner Easy Cash

How Much House Can I Afford Bhhs Fox Roach

Claire Mackay Features In An Article In This Month S Money Magazine S As A Guest Financial Self Managed Super Fund Exper Money Magazine Finance Saving Mackay

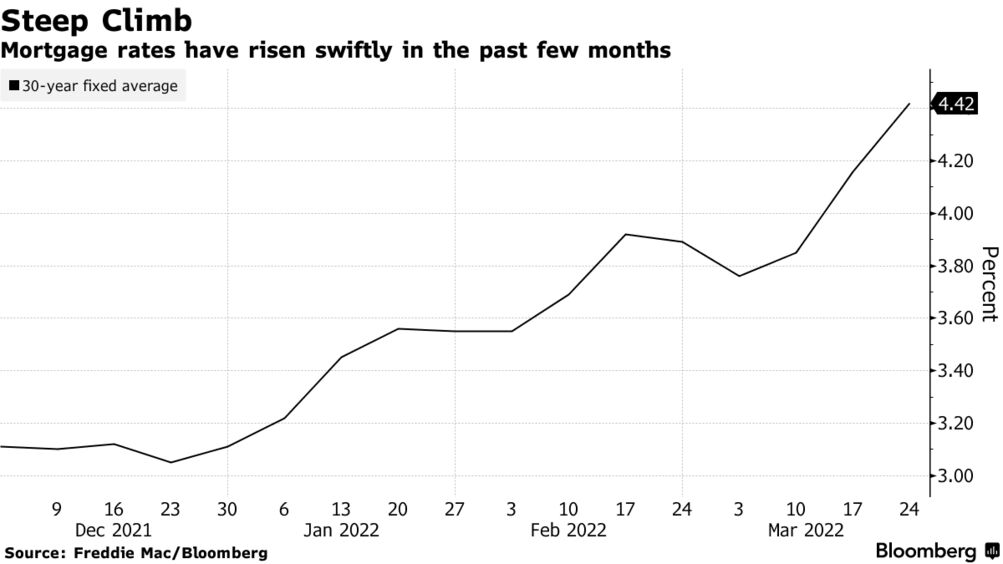

U S Mortgage Rates March 2022 Surge To 4 42 Highest Since January 2019 Bloomberg

Agbo5fvxuoyi1m

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

How Much House Can I Afford Fidelity

5 Year Fixed Mortgage Rates And Loan Programs

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How Will Our Children And Grandchildren Ever Afford To Own A Home Children Grandchildren Generation